Revisiting the Rule of 40 in a Recession

On how SaaS companies can navigate the balance between growth and profitability during a downturn

[Source: What does the Rule of 40 tell about a SaaS company?, Tony Fedorov]

Back in 2015, venture capitalists popularized the “Rule of 40” as a rule of thumb to establish whether a SaaS company’s business model was effective. The principle that a software company’s combined growth rate and profit margin should exceed 40% gained momentum as a neat metric to capture the trade-offs of balancing growth and profitability because it neatly distilled a company’s operating performance into one number.

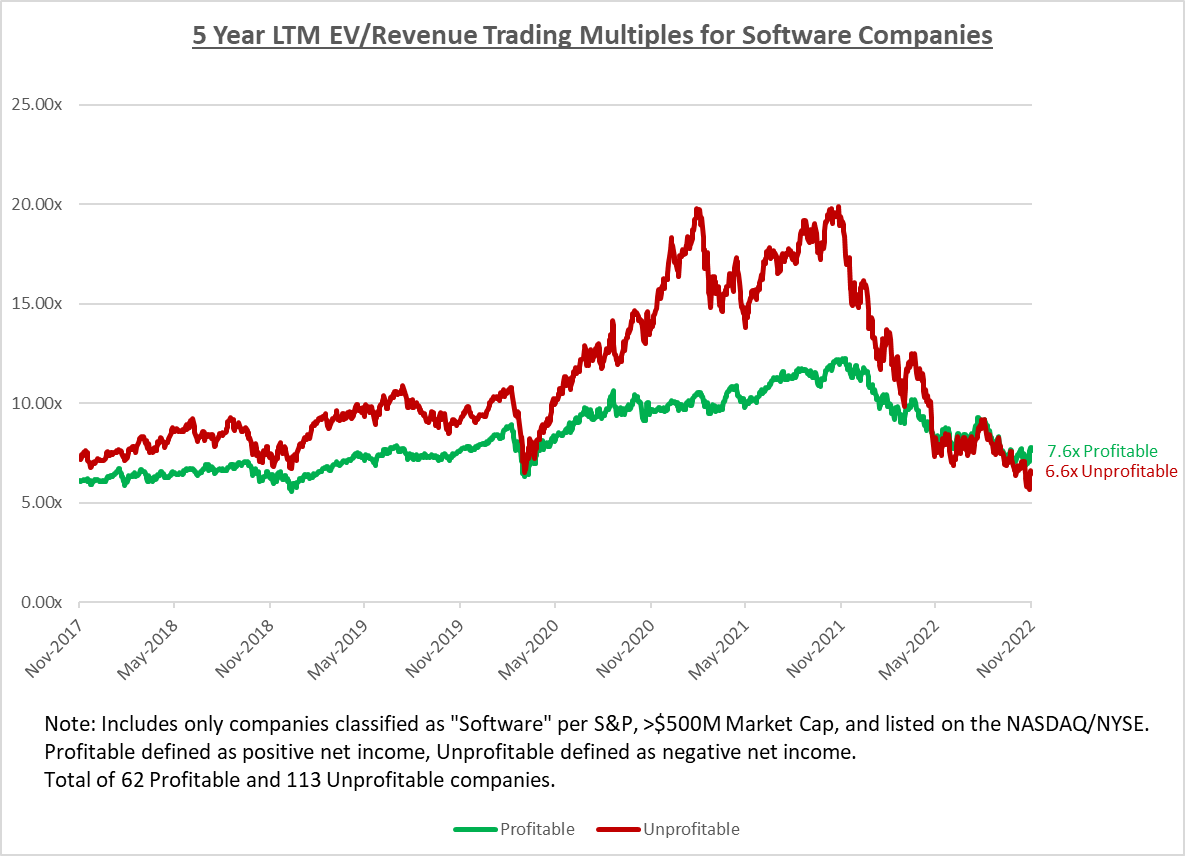

In the peak cycle, SaaS companies embodied a growth-at-all-costs mindset - the historical trading performance of software companies from 2017 to 2021 indicates that fast-growing but unprofitable software companies garnered considerably higher valuations than slower growing but profitable counterparts.

[Source: Balancing Profitability and Growth: Lessons from the Bottom Line, Norwest Venture Partners]

High growth was considered a barometer of product-market fit with a differentiated value proposition and a well-executed go-to-market strategy. In an environment where cash was abundant and cheap, the bar for efficiency was not as high because one could simply raise more capital and continue to grow inefficiently.

However, as the economy slows down, interest rates rise, and investor preference for SaaS companies shifts from favoring growth towards a renewed focus on profitability, the Rule of 40 is put to its real test. As SaaS companies look to solve problems for customers with a renewed focus on using cash wisely, there are certain common themes that emerge as they strive for the desirable balance between growth and profits.

Preserve predictable customers.

Kevin Stoll, former VP of CapGemini Invent, believes that “it makes more sense to spend time on your existing customer set” during a recession. “The cost of acquisition is quite a bit lower. You already know their preferences and what they do, and they know how they use your product.”

In the SaaS business model, increasing customer lifetime value (LTV) is one of the most important measures of the business’ health as it maintains the unit economics despite the upfront costs of customer acquisition. Increasing the LTV of customers during an economic downturn entails upselling existing customers, cross-selling them into products that can help optimize their business or implementing small price increases in customer segments where it seems appropriate (e.g., customer bases with a high Net Promoter Score in terms of loyalty, satisfaction, and enthusiasm with the product; those hit less hard by the recession, etc.).

With the valuable marketing and sales capital saved on acquiring new customers, listen to your existing customers, make improvements to the product and enhance customer experience to gain scale and efficiency.

Pursue efficiency of growth over growth alone.

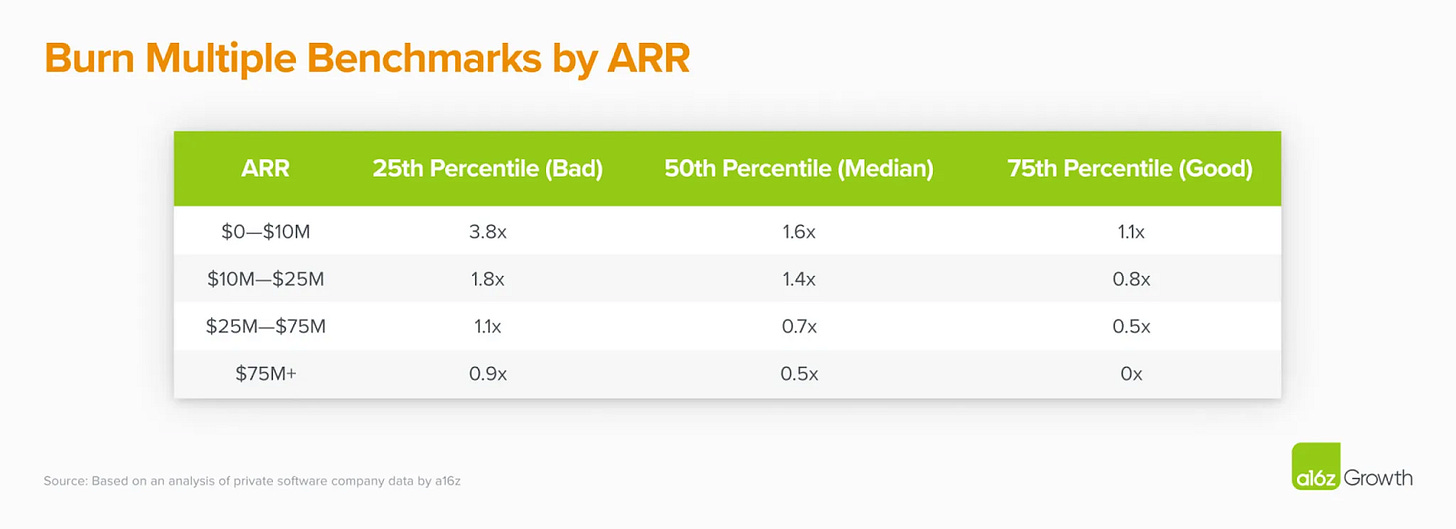

The key to measuring success is understanding how much you spent to deliver annual recurring revenue (ARR) growth. Burn multiple (i.e., capital burnt as a multiple of revenue growth) is a commonly used capital efficiency metric for evaluating SaaS companies with recurring revenue streams. a16z partners Justin Kahl and David George said, "We like burn multiples more than other efficiency metrics for recalibrating when market conditions change because they are all-encompassing of your business activities. Unlike other efficiency scores (e.g., LTV/CAC) that focus just on sales and marketing, actions you take across every business function will impact your burn multiple."

Although good looks different at different stages of company maturity, a burn multiple of one is universally a gold standard - i.e., for every dollar you burn, you add a net new dollar in subscription revenue.

Achieving a low burn multiple in any SaaS environment, and more so in a recessionary one, is a function of achieving product-market fit and sales & marketing efficiency. For an engineering org, this means being laser focused on top priorities to build what is most important to customers in the most cost-effective way. For a go-to-market team, this entails continually streamlining wherever possible - whether it is rationalizing the available offers and price points, channel motions or duplicative operational teams.

Diversify revenue streams.

In early-stage SaaS companies, a few customers often make up a large portion of revenue. However, relying on a single source of revenue can be risky, especially during a recession. Over time, it is important to build a diverse revenue base, whether organically through new products or services or inorganically through partnerships with other companies.

For example, Adobe helped create the desktop publishing revolution with some of their first successful software products for designers, then made a series of smart acquisitions to broaden their market and make deeper inroads into the consumer space and fully transitioned from a licensed software company to a cloud SaaS company to diversify and stay competitive.

(Hustle Fuel represents my own personal views. I am speaking for myself and not on behalf of my employer, Microsoft Corporation.)